About DGCX

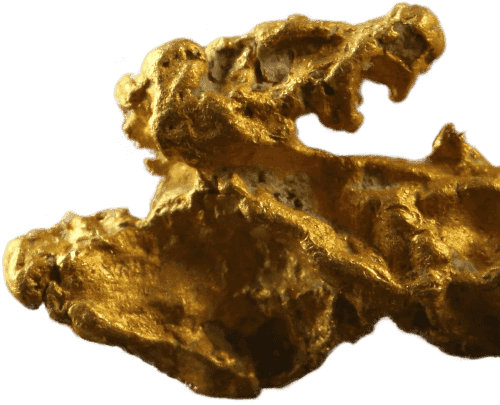

Dubai has historically been an international hub for the physical trade of not only gold, but also many other commodities and so the establishment of the Dubai Gold & Commodities Exchange (DGCX) was the next logical step for the region and the local economy. DGCX commenced trading in November 2005 as the regions first commodity derivatives exchange and has become today, the leading derivatives exchange in the Middle East.

DGCX's range of futures contracts offers participants of the physical commodities markets, such as producers, manufacturers and end users, with a sophisticated means of hedging their price risk exposure. Such price risk management has previously been unavailable to producers in the Middle East. In addition, DGCX offers trading opportunities to financial communities and investment houses in both the Middle East and around the globe who wish to access the growing asset class of commodity and currency derivatives.

LEARN MOREProducts

Since 2005 DGCX has been diligently working with its members and partners to create a unique and diverse product offering.

The DGCX products are split into four clearly defined asset classes; Currencies, Metals, Hydrocarbons and Equities. Each contributes to making the DGCX, the largest and most diversified derivatives exchange in the Middle East.

Products are designed and built in line with the needs of our members, making the DGCX a truly unique proposition for risk management as well as hedging needs.

Explore