DGCX G6 Currency Futures Register Surge in Trading Activity in September

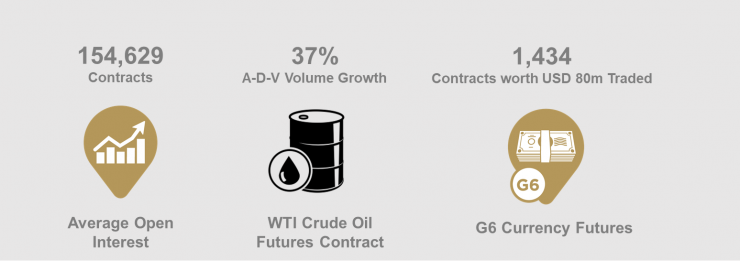

During September, the Dubai Gold and Commodities Exchange (DGCX) once again registered a high monthly Average Open Interest (AOI), amounting to 154,629 contracts.

Open interest is an indicator of the total number of futures contracts held by market participants at the end of the trading day – and the significant increase over the last few months reflects a growing appetite from market participants.

Following trends from the preceding month, the DGCX Group saw renewed interest in its Hydrocarbons asset class during September - with its West Texas Intermediary (WTI) Futures Contract registering a year-on-year (Y-O-Y) Average Daily Volume (ADV) growth of 37%, compared to the same period last year.

The DGCX’s currency portfolio also recorded a spike in trading activity during the month, reflecting increased investor interest in currencies as an alternative asset class. DGCX’s G6 Currencies Portfolio traded a combined total of 1,434 lots valued at USD 80 million. Additionally, the newly launched Pakistani Rupee (PKR) Futures Contract continued to grow in demand, registering a combined value of USD 108 million.

Elsewhere, the exchange’s precious metals’ portfolio also continued to attract interest from market participants with the Shari’ah Compliant Spot Gold Contract the standout performer, trading a total of 20 lots valued at USD 1.14 million.

September’s trading volumes also included block trades with a total trade value of USD 1.07 billion. Through block trades, DGCX’s members and market participants can pre-negotiate a trade with another party; enabling them with the ability to execute a large value transaction at a reasonable price.

Strategic Partnerships

September also saw the DGCX continue to expand its core expertise and offerings to the African region, a key market for the exchange. The DGCX Group signed an MoU with Victoria Falls Stock Exchange (VFEX) – a subsidiary of the Zimbabwe Stock Exchange (ZSE) – to provide VFEX with technical support, knowledge, and skills, with the aim of establishing an international commodities exchange in Zimbabwe.

The agreement marks the second MoU in the African market over recent months, with the DGCX also signing an agreement with the Financial Markets Regulatory Authority (FMA) in Sudan to strengthen bilateral cooperation towards the trading of gold between the United Arab Emirates and Sudan.

Les Male, CEO of DGCX, said: “The DGCX continues to focus on driving growth by enhancing the strength of our offerings to market participants, as well as growing, innovating, and scaling our services. We are therefore pleased to have signed an agreement with VFEX during the month of September, as part of our strategic expansion into the African region, a rapidly growing market with enormous potential. As a globally regulated exchange, we are proud to lend our expertise in other markets and continue to look at ways to expand our range of services, as well as offer market participants with effective ways to hedge risk.”

About DGCX:

The Dubai Gold & Commodities Exchange (DGCX) is the region’s leading derivatives exchange and has played a pioneering role in developing the regional market for derivatives trading, clearing and settlement.

The DGCX owns and operates the region’s largest and only multi-asset Clearing House – Dubai Commodities Clearing Corporation (DCCC). DGCX & DCCC are regulated by the Securities & Commodities Authority (SCA). It is recognised as a licensed Central Clearing-Counterparty (CCP) by SCA and a Third-Country CCP by European Securities Markets Authority (ESMA).

The DGCX’s strategic geographic location in Dubai between the Far East, Europe and Africa serves as a unique, global window for traders and investors. With over 100 members across the world, the DGCX drives liquidity in the market by offering a broad range of futures and options contracts covering base and precious metals – including the world’s only Shari’ah Compliant Spot Gold Contract – hydrocarbons, equities and currencies.

For further information please contact:

Daniel Chinoy

Weber Shandwick PR

Tel: +971 50 255 3402

Email: DChinoy@webershandwick.com