DGCX sees Surge in Demand for INR Product Suite in November

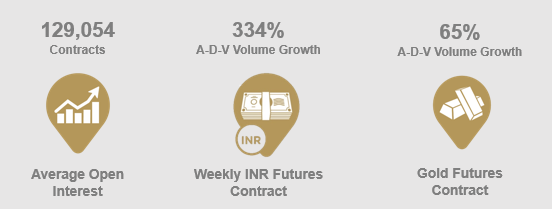

The Dubai Gold & Commodities Exchange (DGCX) saw a strong surge in trading activity in November, primarily driven by its Indian Rupee (INR) product suite, Indian Single Stock Futures (SSF), as well as a sustained uptick in Gold. DGCX continued to register a high monthly Average Open Interest (AOI) of 129,054 contracts for November.

During the month of November, the DGCX’s Weekly INR-US Dollar (USD) Futures Contract once again performed strongly - achieving its second-highest volume as well as trading value since its launch in 2020. The contract recorded a year-on-year (Y-O-Y) Average Daily Volume (ADV) growth of 334%.

The DGCX Group’s Indian Rupee Options Contract also registered a year-to-date (YTD) volume growth of 527% compared to the same period last year, as market participants looked to manage their risk exposure. Additionally, the DGCX Group also saw its Indian SSF product register a Y-O-Y Average Daily Volume (ADV) growth of 441% - indicating an appetite from investors for blue-chip Indian stocks.

There was also continued interest in precious metals during the month, as the DGCX’s Flagship Gold Futures Contract recorded a Y-O-Y ADV growth of 65%.

Les Male, CEO of DGCX, said: “During November, there was an increased demand for Indian rupee backed assets and a variety of hedging instruments, as market participants looked to hedge or manage their exposures to the Indian market. Trading activity was driven by several factors, such as strong inflows from IPOs in India, an anticipation of Fed Rate hikes, as well as oil price volatility.

“As we look forward to the next 50 years in the UAE, the DGCX will continue to expand its services and infrastructure to support the growth of the market, as well as play a leading role in solidifying the UAE’s position as an international trading hub. We see a future in which an even wider range of market participants will have access to the benefits associated with our contracts - enabling them to grow and diversify their trading opportunities.”

About DGCX:

The Dubai Gold & Commodities Exchange (DGCX) is the region’s leading derivatives exchange and has played a pioneering role in developing the regional market for derivatives trading, clearing and settlement.

The DGCX owns and operates the region’s largest and only multi-asset Clearing House – Dubai Commodities Clearing Corporation (DCCC). DGCX & DCCC are regulated by the Securities & Commodities Authority (SCA). It is recognised as a licensed Central Clearing-Counterparty (CCP) by SCA and a Third-Country CCP by European Securities Markets Authority (ESMA).

The DGCX’s strategic geographic location in Dubai between the Far East, Europe and Africa serves as a unique, global window for traders and investors. With over 100 members across the world, the DGCX drives liquidity in the market by offering a broad range of futures and options contracts covering base and precious metals – including the world’s only Shari’ah Compliant Spot Gold Contract – hydrocarbons, equities and currencies.

For further information please contact:

Daniel Chinoy

Weber Shandwick PR

Tel: +971 50 255 3402

Email: DChinoy@webershandwick.com