DGCX’s PKR Futures and Weekly INR Contracts Gain More Momentum in July

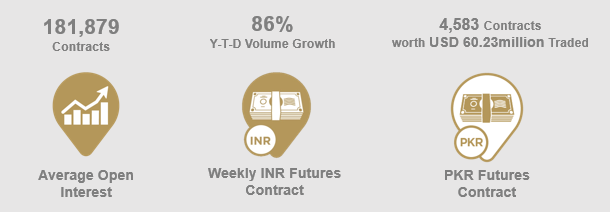

During the month of July, the Dubai Gold and Commodities Exchange (DGCX) registered a monthly Average Open Interest (AOI) of 181,879 contracts.

Notably, the DGCX Group’s Weekly INR-US Dollar (USD) Futures Contract, recorded a year-to-date (Y-T-D) volume growth of 86% this July, compared to the same period last year, when it first went live in July 2020. The Contract has since provided market participants with opportunities for further diversification, short-term hedging, and arbitrage opportunities while tracking the world’s largest pool of offshore liquidity for exchange-traded INR-USD currency products available at DGCX.

The Pakistani Rupee (PKR) Futures Contract also continued to surge in interest since its launch earlier in the year, registering a combined total of 4,853 lots valued at USD 60.23 million during the month. Moreover, the Silver Futures Contract also continued its strong performance, recording a year-to-date (Y-T-D) volume growth of 83%, compared to the same period last year. Significantly, another product from the DGCX Group’s metals portfolio performed strongly throughout the year – with the exchange’s Gold Futures Contract trading a combined total of 34,985 lots worth USD 2.02 billion since the beginning of 2021, to date.

Les Male, CEO of DGCX, said: “During July, the Weekly INR Futures Contract attracted a surge in interest, as members looked to manage their exposure to the Indian market. Since its launch last year, the contract has been particularly beneficial for market participants looking for short-term contracts to meet their business and hedging requirements – and we continue to look at ways to build on the success of our INR portfolio. We also continued to record marked interest in the DGCX Group’s PKR Futures Contract, which has now registered the highest trades since its launch in April, as well as the second highest volume, value and Open Interest. We remain focused on providing our members with a wide range of products to manage their risk effectively and expect to announce further solutions in the coming months.”

About DGCX:

The Dubai Gold & Commodities Exchange (DGCX) is the region’s leading derivatives exchange and has played a pioneering role in developing the regional market for derivatives trading, clearing and settlement.

The DGCX owns and operates the region’s largest and only multi-asset Clearing House – Dubai Commodities Clearing Corporation (DCCC). DGCX & DCCC are regulated by the Securities & Commodities Authority (SCA). It is recognised as a licensed Central Clearing-Counterparty (CCP) by SCA and a Third-Country CCP by European Securities Markets Authority (ESMA).

The DGCX’s strategic geographic location in Dubai between the Far East, Europe and Africa serves as a unique, global window for traders and investors. With over 100 members across the world, the DGCX drives liquidity in the market by offering a broad range of futures and options contracts covering base and precious metals – including the world’s only Shari’ah Compliant Spot Gold Contract – hydrocarbons, equities and currencies.

For further information please contact:

Daniel Chinoy

Weber Shandwick PR

Tel: +971 50 255 3402

Email: DChinoy@webershandwick.com